|

There is one other significant factor in his style of financial management. He was (at least after retirement) very generous with his resources.

*In 1958, the fruits of his financial efforts having begun to pay off handsomely, Papa Frank gave the first of many gifts to the Nazarene denomination and its mission program, a donation of $100,000. It was such a noteworthy contribution at the time that the Associated Press carried the story throughout the country. As a benefactor, he probably gave more back to the church than he had ever received in payment from it. He also set up a large trust for Mama Pearl and his surviving children, Leon, Lucile, and Mabel.

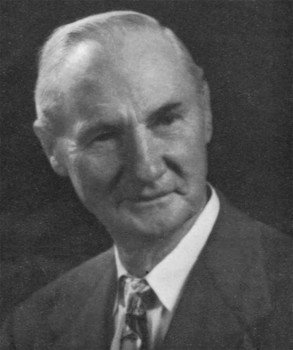

| Papa Frank from his Austin, TX, days,

likely about 1965. |

In addition to earlier stock and cash donations, amounting to close to a half-million dollars, the estate he and Mama Pearl had built up, from practically nothing, and on a very limited income, was worth $1,000,000 when he died in March, 1970, at age 85. Back then a million dollars was still considered a lot of money!

Some may think Papa Frank was too harsh, unnecessarily tough. But they were tough times, times of men like J.P. Morgan, Henry Ford, Theodore Roosevelt, Joseph Stalin, Adolf Hitler, George Patton, Douglas MacArthur, Emperor Hirohito, Mao Tse-Tung, Benito Mussolini, Chiang Kai-Shek and Winston Churchill. Maybe tough is what was called for to get ahead then.

Leon and his father had their differences, and they were significant, but my dad would always speak with understandable pride of Papa Frank's financial success, acquired though he never earned more than $200/month, and often much less.

My father's father helped me learn to ride a bike, play shuffleboard, horseshoes, softball, and croquet, study insects and other small critters, and hammer in a nail with force and precision. I do not know how he was with his own young children. With his grandkids, Papa Frank was affectionate, patient, and fun. He had a keen intelligence, an infectious sense of humor, and an active, involved way of relating to others and to things that needed doing. He was a neat old man. If I'm lucky, he will also have helped inspire me to be a good investor.

(The above is based on Larry and his mom, Julia's, recollections. If others, especially Papa Frank's daughter and son-in-law, Lucile and Shelby, respectively, have either corrections or supplements they can add to the account, the new information would be most welcome.)

| |